CRM dumpster fire? DealSignal can keep your data refreshed automatically.

Power your programs with fresh, accurate data to drive better results.

Achieve comprehensive, accurate info on your total audience.

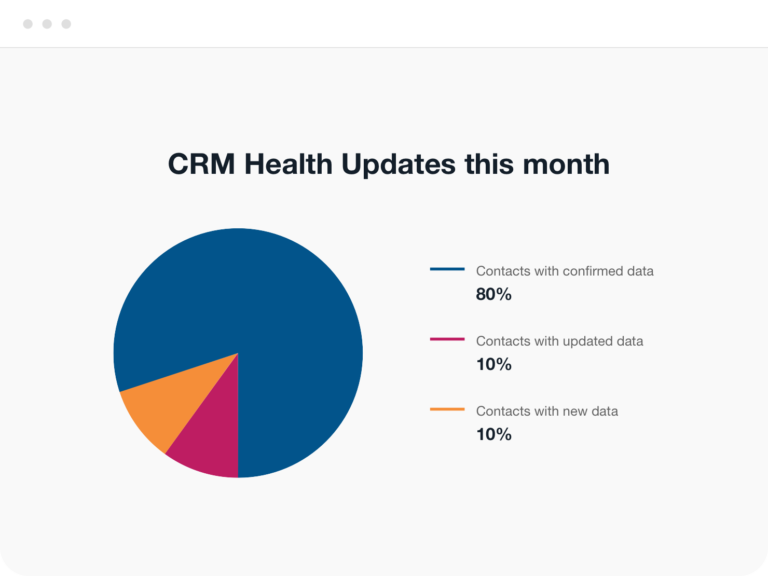

DealSignal makes it easy to automatically refresh your CRM data—and keep it fresh on a regular schedule.

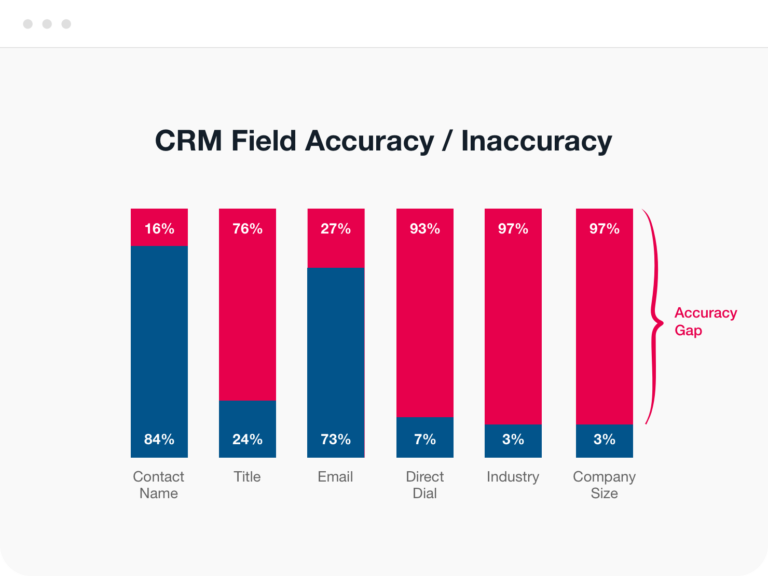

Get a baseline analysis of how spotty and outdated your CRM data is. On average, up to 50% is typically inaccurate and incomplete!

Choose your preferred refresh and enrichment options and launch your initial refresh. You can pick just a segment, such as ABM accounts, or all your accounts, contacts and leads.

Detailed firmographics, direct-dial and corporate phones, verified email, job title, social URLs, even persona fit and buyer intent...100+ available fields automatically refreshed and enriched.

Choose a monthly, quarterly or custom schedule for DealSignal to refresh, enrich, and reverify your data. Bi-directional CRM integration makes it easy.

The DealSignal platform takes a dynamic, AI-driven, on-demand approach to data enrichment and verification to deliver unparalleled match rates and 97%+ accuracy with a 100% data guarantee.