Targeting CEOs in the US market is a strategic endeavor for many businesses due to their influential roles in decision-making, company direction, and industry influence. Conducting a Total Addressable Market (TAM) analysis specific to this demographic is particularly crucial for several reasons, especially when leveraging platforms like LinkedIn for data insights:

- Identifying growth opportunities: CEOs often hold the keys to significant budget allocations and strategic initiatives within their organizations. Understanding the size and scope of the market segment they represent enables businesses to identify growth opportunities and allocate resources effectively.

- Precision targeting: CEOs are a niche audience with specific needs, challenges, and priorities. TAM analysis helps businesses tailor their marketing and sales efforts to resonate with this audience, leading to higher engagement and conversion rates.

- Optimizing resource allocation: Targeting CEOs requires investment in resources such as marketing campaigns, sales outreach, and product development. TAM analysis ensures that resources are allocated efficiently by focusing on segments with the highest potential for ROI.

- Mitigating risk: By thoroughly understanding the TAM for CEOs in the US market, businesses can mitigate risks associated with market entry or expansion. This includes assessing factors such as market saturation, competitive landscape, and potential barriers to entry.

- Informing product development: Insights from TAM analysis can inform product development strategies by highlighting areas where CEOs have unmet needs or pain points. This allows businesses to develop solutions that resonate with this influential audience, driving innovation and differentiation.

- Enhancing customer engagement: CEOs are busy professionals who value personalized and relevant interactions. TAM analysis enables businesses to segment their CEO audience based on factors such as industry, company size, and geographic location, facilitating more targeted and meaningful engagement.

- Driving revenue growth: Ultimately, targeting CEOs effectively can lead to increased revenue and business growth. TAM analysis provides the foundation for developing strategies that align with CEO priorities and preferences, driving success in the marketplace.

By conducting a TAM analysis leveraging LinkedIn data, DealSignal is providing businesses with actionable insights that enable them to target CEOs in the US market with precision and confidence. This approach not only bridges the gap in comprehensive market coverage but also empowers businesses to unlock new opportunities and drive sustainable growth.

TAM analysis approach and structure

We’ve recognized the challenge of accurately targeting CEOs and Founders on LinkedIn, especially when considering specific niches. To address this, we’ve meticulously filtered LinkedIn’s vast pool of professionals, focusing on job titles “CEO” and “Founder” while excluding related titles like “Assistant.” This process ensures that our data reflects the most relevant audience for your sales efforts.

Our analysis provides insights into the Total Addressable Market (TAM) for CEOs and Founders in the US across various parameters such as company size, location (state), and industry. By utilizing LinkedIn’s Sales Navigator, we’ve curated a comprehensive dataset that allows you to access this valuable information with ease.

We understand that data accuracy is paramount for effective sales targeting. That’s why our data will be updated quarterly to ensure that you’re always working with the latest and most precise information available.

While our current approach may not be perfect due to the limitations of LinkedIn or other factors, we’re committed to continuously improving our methods. We welcome any suggestions or feedback to refine our processes further and provide you with even more accurate and actionable data for your sales initiatives.

TAM analysis criteria

- Size: Analyzing companies based on their size, from startups to enterprise-level organizations in the United States.

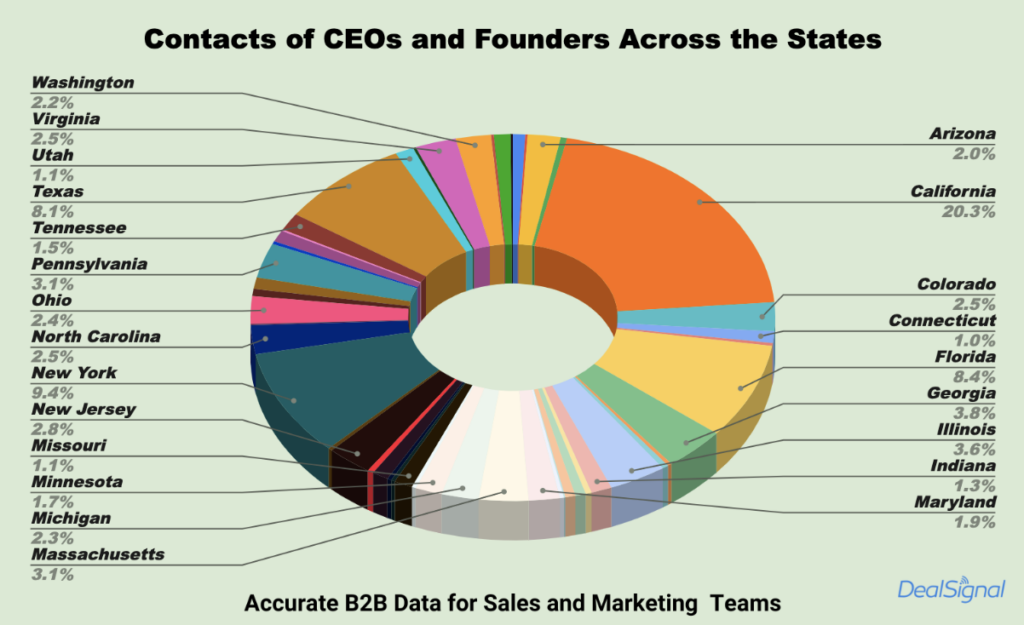

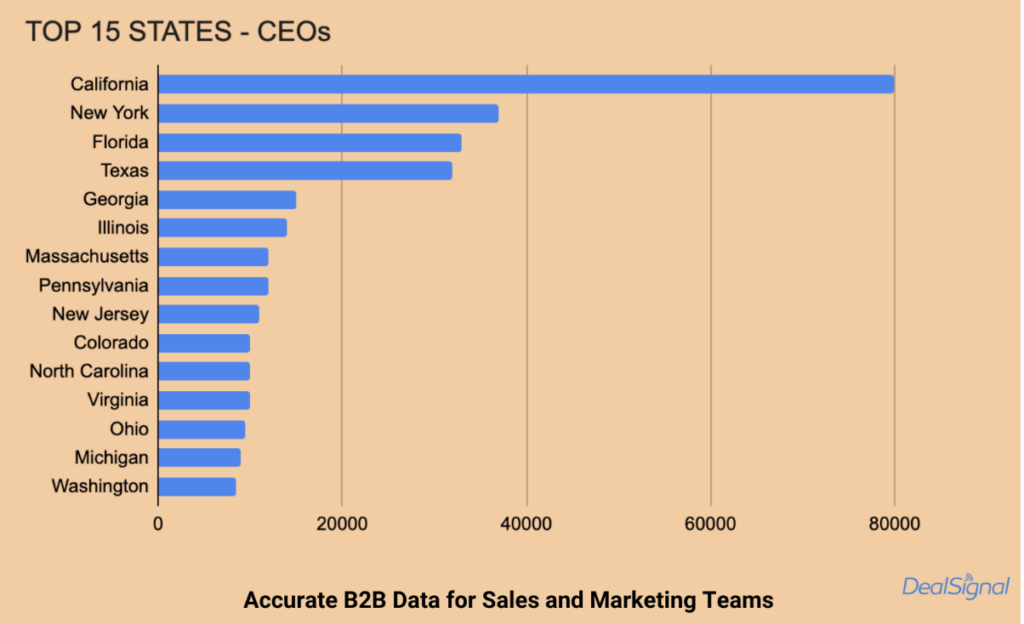

- State: Examining data according to geographical locations within the United States.

- Industry: Segmenting data based on the industry in which companies operate, providing insights into specific sectors such as technology, healthcare, finance, and more.

- Industry groups: Manually categorizing industries into groups for easier analysis and comparison.

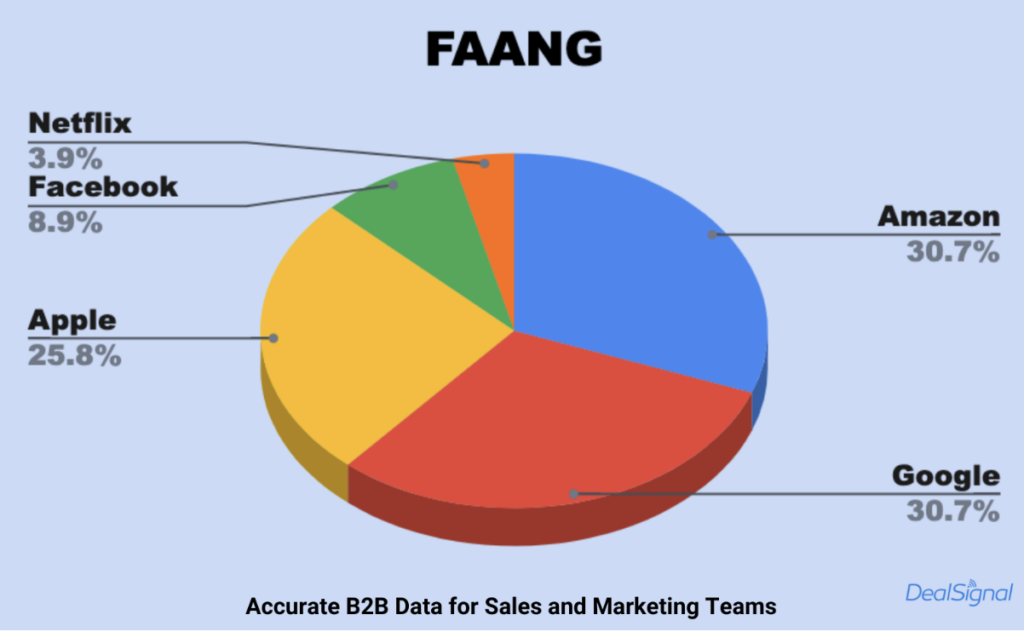

- Past company: Identifying past employers of individuals, including notable companies like FAANG (Facebook, Apple, Amazon, Netflix, Google) and high-growth startups like Deel.

- Company type: Differentiating companies within the same industry based on factors like size and structure.

- Company HQ location: Distinguishing between companies headquartered within the United States and those outside the country.

- Years in current position: Analyzing tenure in current roles, with insights based on company size and industry.

- Years in current company: Examining the duration of individuals’ employment with their current employers, segmented by company size and industry.

- Years of experience: Assessing individuals’ overall professional experience, considering factors like company size and industry.

- Activity on LinkedIn: Tracking individuals’ activity on LinkedIn, categorized by company size and industry.

- Mentions in news: Monitoring mentions of individuals or companies in news articles, segmented by company size and industry.

Accounts and CEOs comparison

When examining LinkedIn data, it becomes evident that California emerges as the primary hub for both accounts and CEOs, showcasing its dominance in the professional landscape. Furthermore, Florida and New York also hold significant presence, not only among CEOs but also in terms of accounts.

Delving deeper into the company size dynamics, California asserts its supremacy particularly in the bracket of 201-500 company size, capturing a substantial 63.5% share in the account.

This comparison underscores California’s multifaceted appeal, showcasing its prowess in accommodating both established corporations and burgeoning enterprises across various company sizes. As the data suggests, California’s allure extends beyond its renowned tech hub status, making it a compelling destination for professionals and businesses alike on LinkedIn.

CEO data takeaways

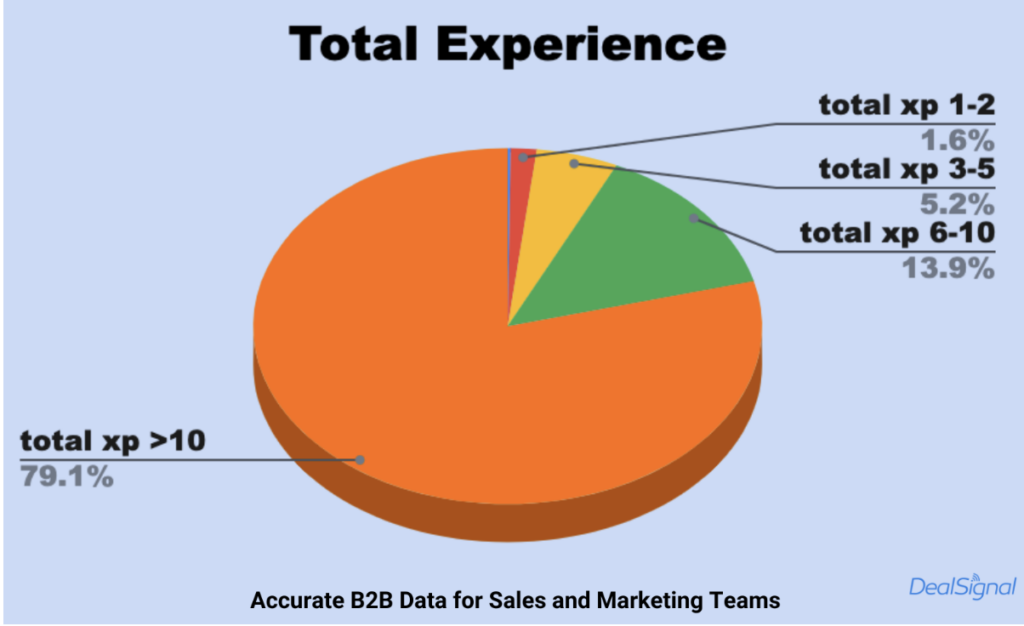

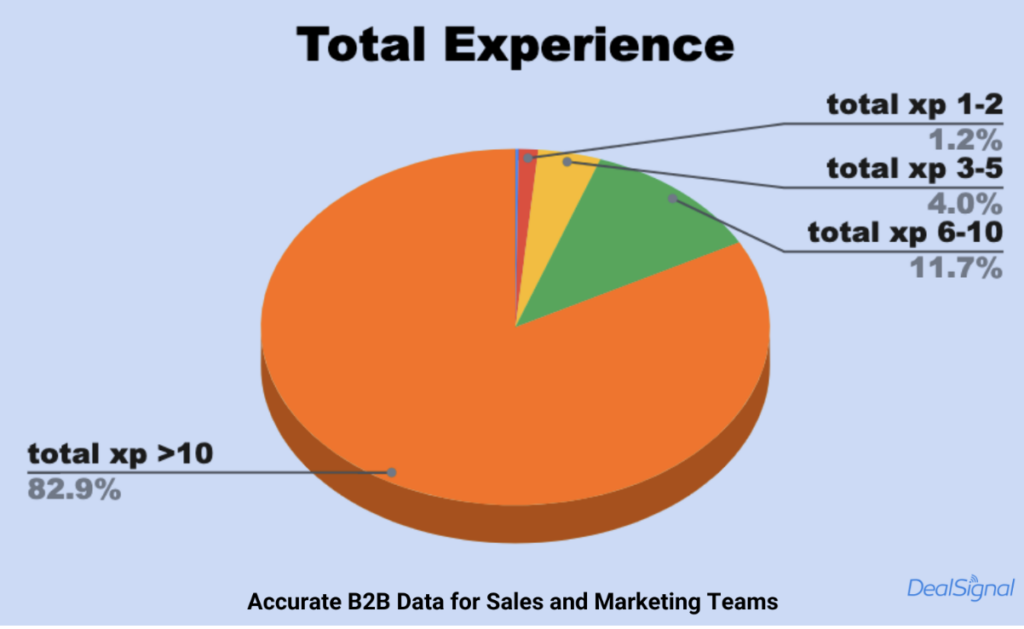

When comparing CEO demographics across different company sizes, a notable trend emerges regarding CEO experience.

For CEOs in companies with 1-10 employees and 11-50 employees, the majority (79.1% and 82.9%, respectively) have less than 10 years of experience. This suggests a prevalence of relatively newer entrants into CEO roles within smaller organizations.

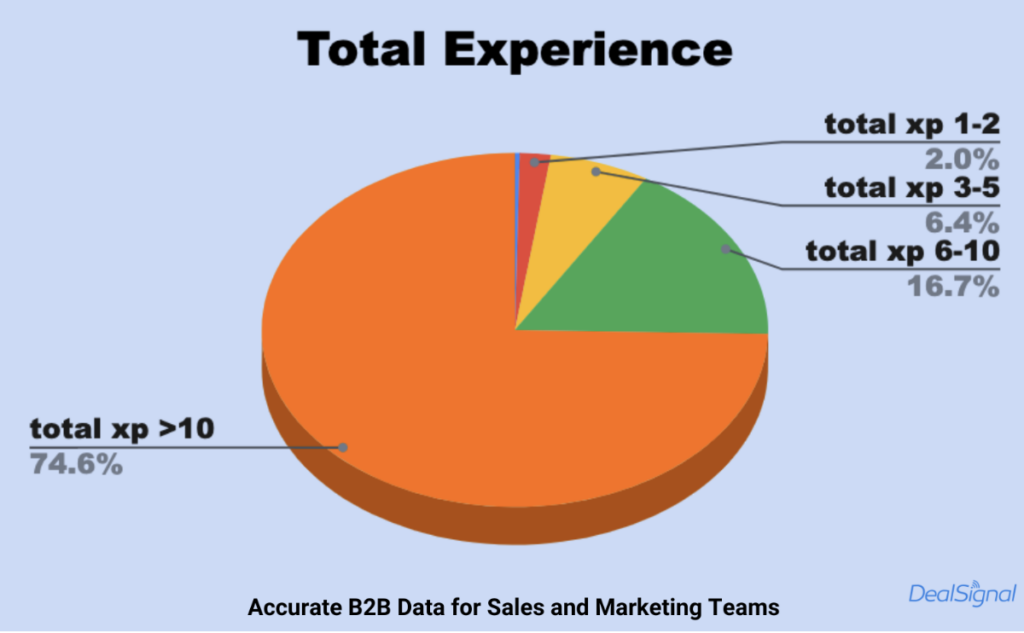

As company size escalates to 100,000+, there’s a discernible shift in CEO demographics. Here, 74.6% of CEOs have less than 10 years of total experience, indicating a substantial proportion of newer CEOs even in larger corporations.

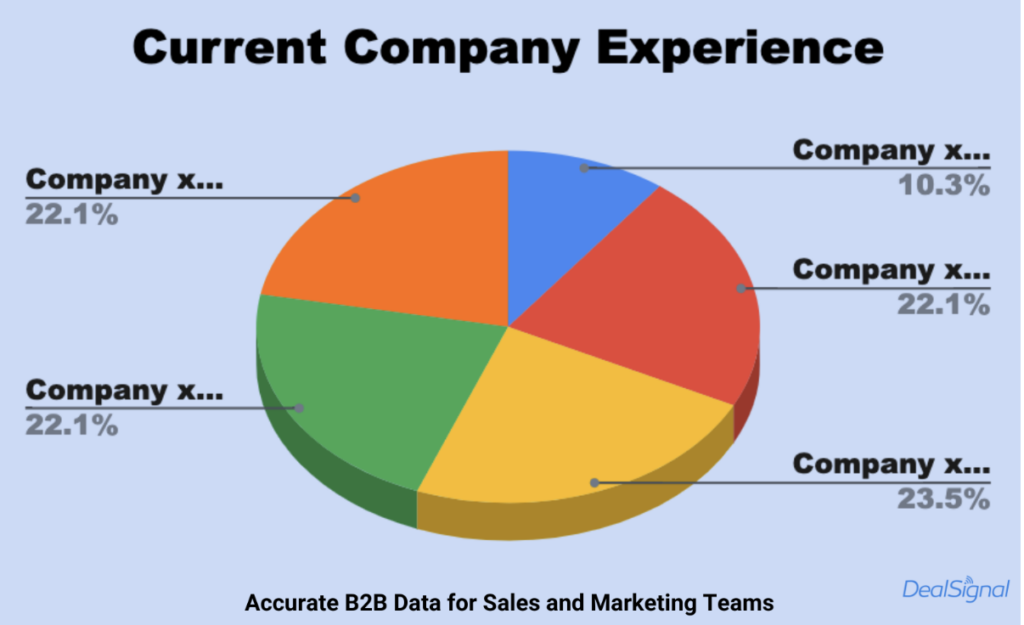

The proportion of CEOs with experience in their current company for 3-5 years remains relatively consistent across company sizes, ranging from 23.5% to 27%. This suggests that a significant portion of CEOs across various company sizes have recently assumed leadership roles within their current organizations.

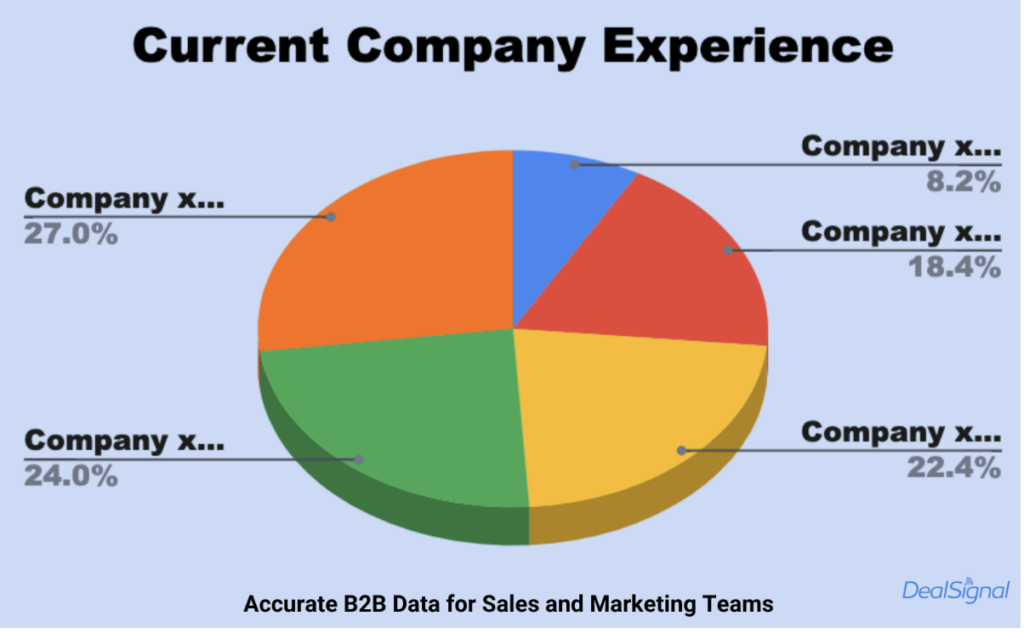

Regarding tenure in their current position, the figures hover around 40.2% to 44.9% across different company sizes, indicating a comparable prevalence of CEOs who have held their current position for some time.

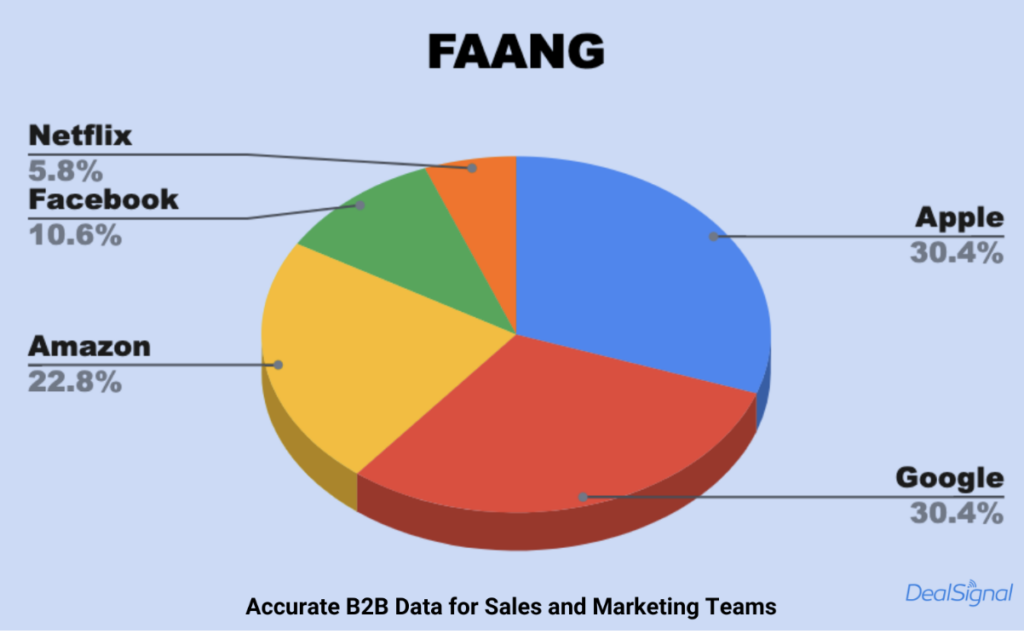

Interestingly, while there’s consistency in the proportion of CEOs with experience with FAANG companies, specifically at Google across company sizes (ranging from 30.4% to 36.7%), CEOs leading companies with 100,000+ employees show a slightly higher rate of experience with both Google and Amazon (30.7%).

Comparison of CEOs’ experience within different industries

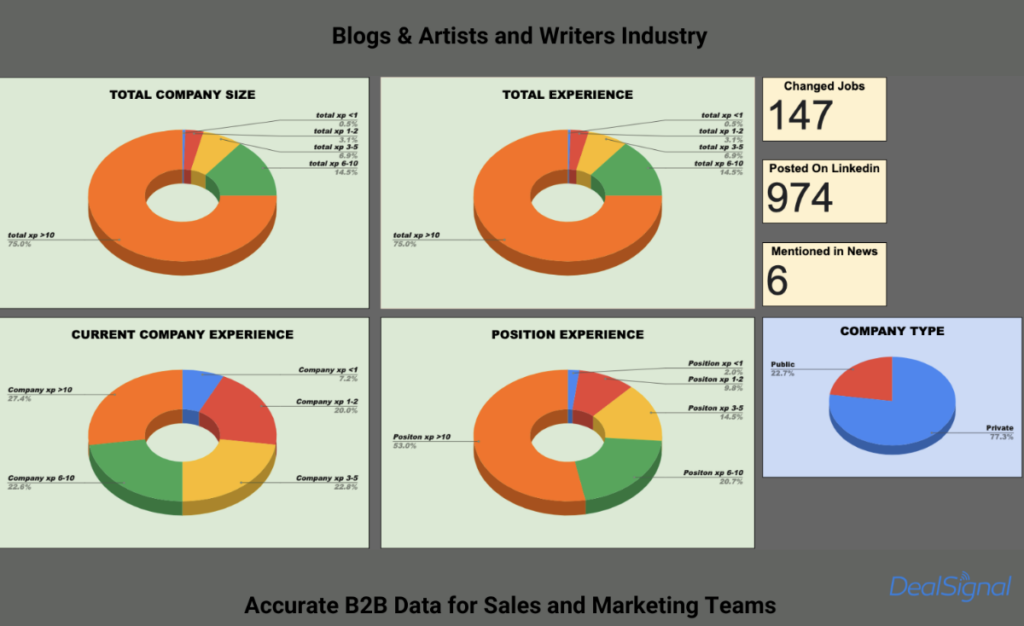

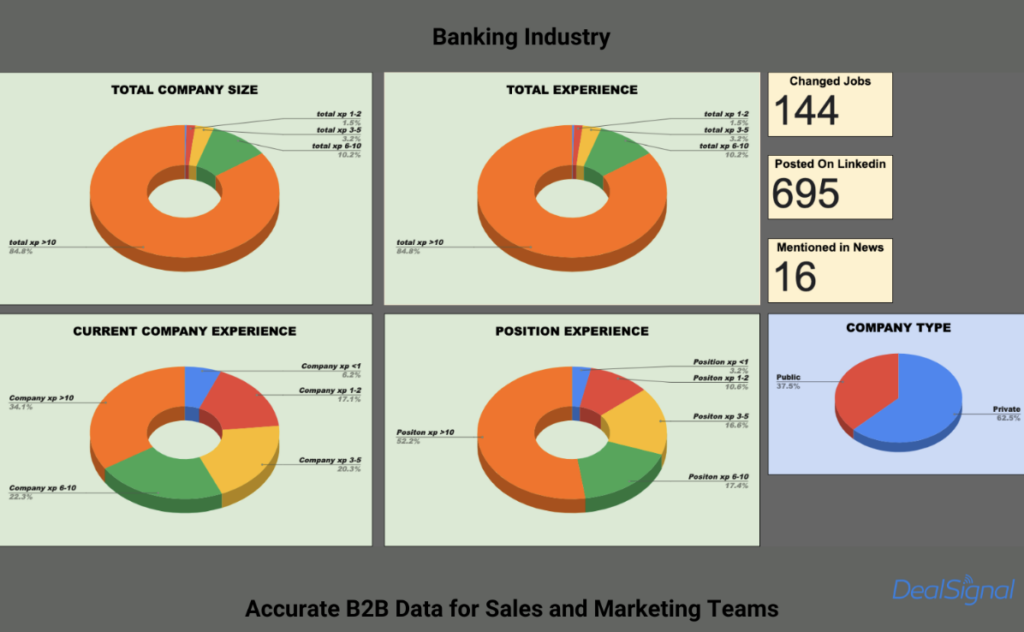

In comparing the CEO experience results between the modern industries of blogs and writers and the traditional banking industry, several noteworthy differences emerge:

- Total experience: While both industries exhibit a high percentage of CEOs with more than 10 years of total experience (75% for blogs and writers vs. 84.8% for banking), the banking industry slightly edges out the modern industries in this aspect.

- Current company experience: Interestingly, the modern industries of blogs and writers show a higher percentage of CEOs with more than 10 years of experience within their current company compared to the banking industry (27.4% vs. 34.1%). This suggests a greater level of loyalty or longevity among CEOs within their current organizations in modern industries.

- Position experience: The percentage of CEOs with more than 10 years of experience in their current position is comparable between the two industries, with blogs and writers at 53% and banking at 52.2%. This indicates a similar level of stability or expertise in their respective leadership roles.

- Job changes: Despite the perception of modern industries being more fluid and dynamic, the number of job changes among CEOs in both industries is relatively similar, with 147 changes in the blogs and writers industry and 144 changes in banking.

- LinkedIn activity and news mentions: Interestingly, CEOs in the blogs and writers industry appear to be more active on LinkedIn, with 974 posts compared to 995 posts in banking. However, the banking industry garners more mentions in the news, with 16 compared to 6 for blogs and writers.

Overall, while the modern industries of blogs and writers exhibit some unique characteristics such as higher longevity within current companies and greater LinkedIn activity, the traditional banking industry still maintains a strong presence in terms of CEO experience and news visibility.

Conclusion

From identifying growth opportunities to informing product development and enhancing customer engagement, the insights gleaned from TAM analysis enable businesses to make informed decisions for targeting CEOs in the US market. By leveraging LinkedIn’s vast pool of professionals, businesses can precisely target CEOs based on factors such as company size, industry, location, and experience, ensuring that their sales efforts are both targeted and effective.

The comparison between accounts and CEOs provides valuable insights into the dynamics of the US market, highlighting trends and patterns that shape executive leadership across different company sizes. From the prevalence of newer CEOs in smaller organizations to the nuanced shifts in demographics as company size increases, the data underscores the importance of continuous analysis and adaptation in navigating the complexities of today’s business landscape.

By embracing data-driven approaches to targeting CEOs in the US market, businesses can unlock new opportunities, mitigate risks, and drive sustainable growth. With DealSignal as a valuable source of data and insights, businesses have the means they need to succeed in reaching and engaging this influential audience, propelling their growth journey forward with confidence and clarity.

Unlock the secrets to targeting CEOs and Founders on LinkedIn with precision.

Download the FREE report to access invaluable insights and optimize your sales and marketing strategies.